09 Jun Burner credit cards protect your privacy, keep you from overspending

[ad_1]

For your eyes only

I’d be hard pressed to think that someone, somewhere hasn’t had their credit card hacked. And always at the worst possible time. You know the drill: You discover a transaction that occurred in Istanbul and you don’t remember when you were there. So you call your credit card company and the card is shut down and you are stranded (maybe not literally) without a card for at least a week until you get a new card.

![]()

The solution? Don’t use your credit card. Well that’s not really an option. How about a prepaid credit card? I think we’re getting warmer.

How about Privacy.com?

Safety first

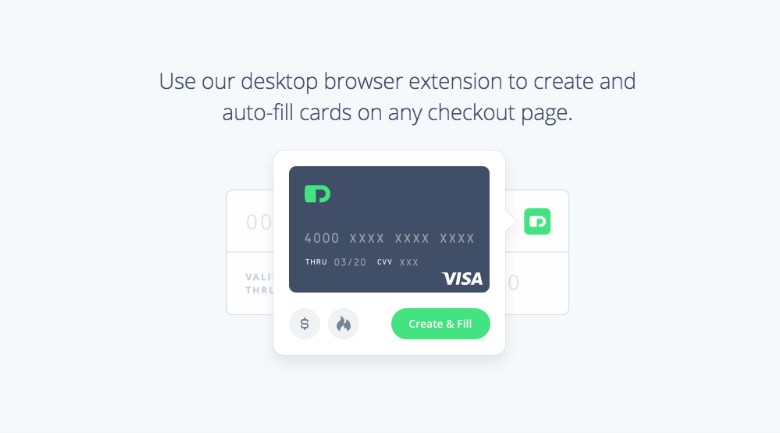

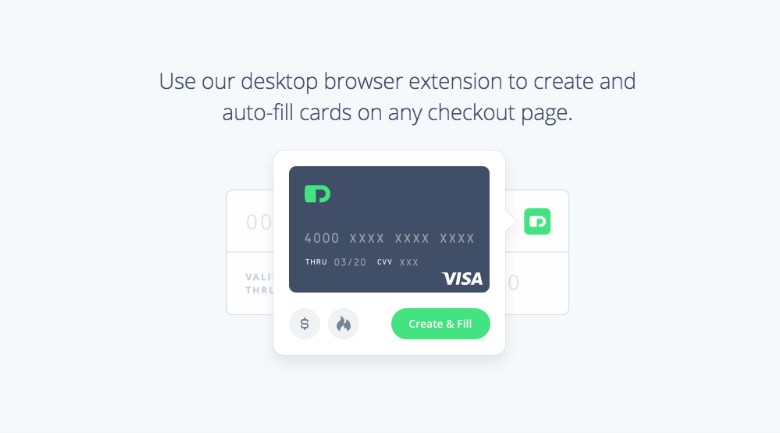

As startups go, at least this one has your best interests in mind. Privacy is the first payments product that keeps your personal information private. And the best thing is, it’s even easier than using your regular credit card online. Privacy Visa cards may be used everywhere Visa debit cards are accepted.

According to their FAQ, “Privacy.com generates virtual card numbers that protect your security and privacy when you shop online.

The virtual cards are locked down to a single merchant and you can make them single-use (burner cards) and set transaction or monthly spending limits on them.

Privacy connects directly to your bank account, so you only need to have a bank account at one of our supported financial institutions to use Privacy.”

Stay connected

Privacy will issue you a random 16-digit Visa card number that you can use at merchants that accept Visa debit cards. You can set spending limits, controls, and close this virtual card anytime you want. Your bank account isn’t charged on card creation. It is only charged when you decide to actually spend using the card you generate.

What’s more, Privacy currently supports Google Chrome and Mozilla FireFox. It’s also available in the iOS App store. Support for Safari and Internet Explorer is said to be coming online soon.

Most big banks accepted

Privacy covers most banks: Bank of America, Capital One 360, Charles Schwab, Chase, Citibank, Fidelity, Navy Federal Credit Union, PNC Bank, SunTrust, TD Bank, US Bank, USAA, and Wells Fargo. As the concept grows in popularity so does the user list. Every time you spend using a Privacy card, the merchant or website pays a fee (called interchange) to Visa and the issuing bank. This fee is shared with Privacy.

That’s how they make their money and how the service remains FREE for users.

Hackers are getting increasingly skilled in their attempts to invade our personal security. Privacy.com is doing its part to stay one step ahead of the con and keep consumers safe.

#Privacy

[ad_2]

Source link

Social Media Agency, Social Media, Digital Marketing, Digital Marketing Agency, Search Engine Marketing, SEO, digital marketing agency dubai, video content marketing, crossfit marketing dubai, video marketing dubai, digital marketing agency abu dhabi, facebook marketing dubai, facebook marketing abu dhabi, digital marketing agencies in dubai, social media agency, content marketing dubai, content strategy dubai, branding dubai